Mortgage Investment

What is a MIC?

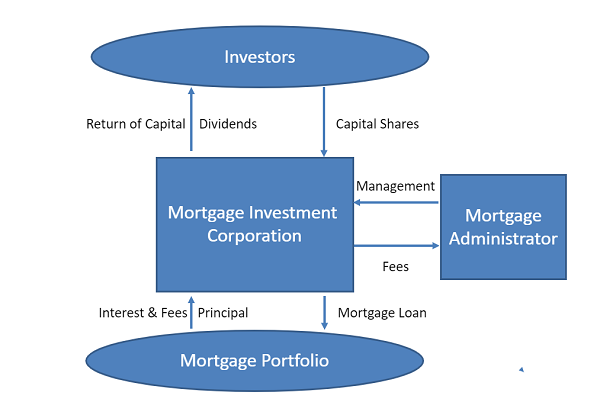

The government of Canada introduced MICs in 1973, through the Residential Mortgage Financing Act, to make it easier for individual and corporate investors to participate in the residential mortgage and real estate markets. Investors pool their money by buying shares of a MIC. The pooled capital funds mortgages, which generate income through interest and fees from the borrower that are ultimately paid as dividends to each investor.

Why Invest in a MIC?

- Secured Investment

MIC provides short term loans secured by real estate properties.

- Risk Mitigation

Risk exposure is mitigated by spreading the investment into a mortgage portfolio rather than a single mortgage.

- Income Stream

A steady stream of income is provided to the investors while the investments are secured by real property.

- External Auditing

Auditing by Licensed Public Accountants ensures comprehensive and transparent financial reporting.

- Tax Shelter

MIC is eligible for investment from registered funds such as RRSP, RESP, TFSA. This allows the investment to grow in a tax-efficient manner.